Payment plans create ongoing work.

Offering payment plans doesn’t end at checkout. Once a plan is active, businesses must manage:

Billing and recurring

payments

Ongoing customer

communication

Missed payments

and follow-ups

Escalations

and disputes

Compliance

and reporting

For most businesses, this creates operational drag — or forces teams to absorb complexity that distracts from core work. Credee removes this burden by fully servicing payment plans end to end.

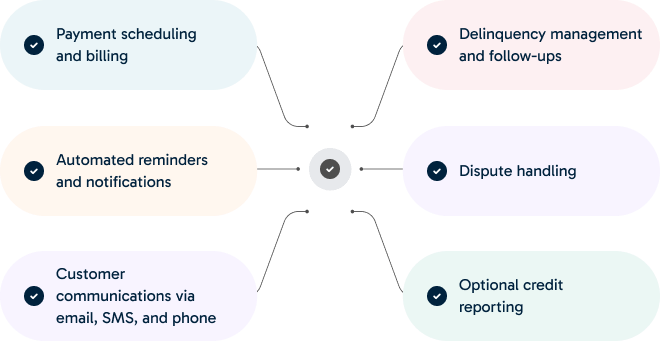

Servicing, not just processing.

End-to-end plan servicing means Credee manages the entire lifecycle of a payment plan after it is created.

All servicing is handled behind the scenes and delivered under your brand.

Consistent communication is key.

Credee manages ongoing communication with customers throughout the life of a payment plan — ensuring clarity, consistency, and professionalism.

Automated payment reminders

Balance updates and confirmations

Missed payment notifications

Escalation workflows when needed

Human support when required

Your customers hear from you — not a third party.

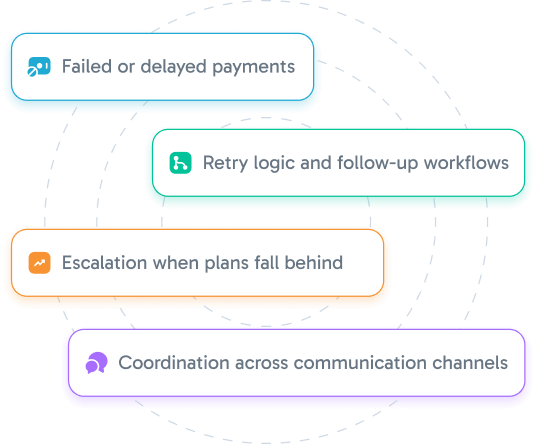

Built for real-world payment behavior.

Not all payments go as planned. Servicing exists to manage this reality.

Designed for Platforms and Enterprises

For Platforms & SaaS Providers

-

Offer payment plans without building servicing teams

-

Avoid becoming a billing or collections operation

-

Deliver a complete, embedded revenue experience

For Enterprise Businesses

-

Eliminate internal payment-plan servicing overhead

-

Reduce strain on finance and support teams

-

Maintain focus on core operations

Offload operations, without losing control.

Explore how Credee can manage the full lifecycle of your payment plans behind the scenes.