Revenue Exists. Cash Flow Lags.

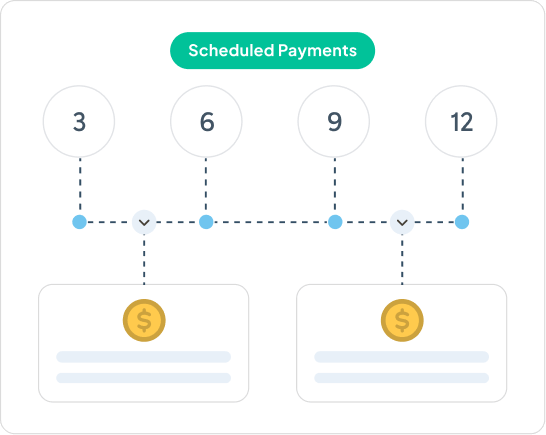

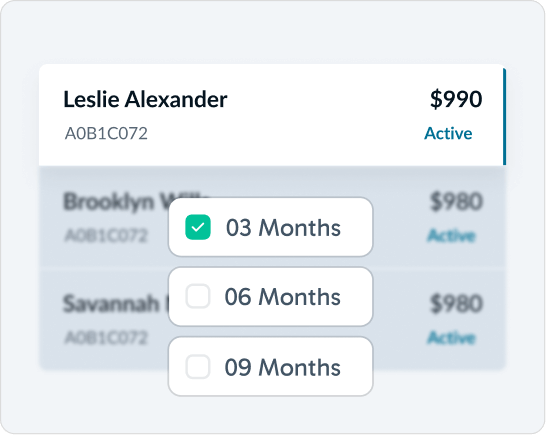

Flexible payment options are great to unlock revenue — but cash often arrives slowly.

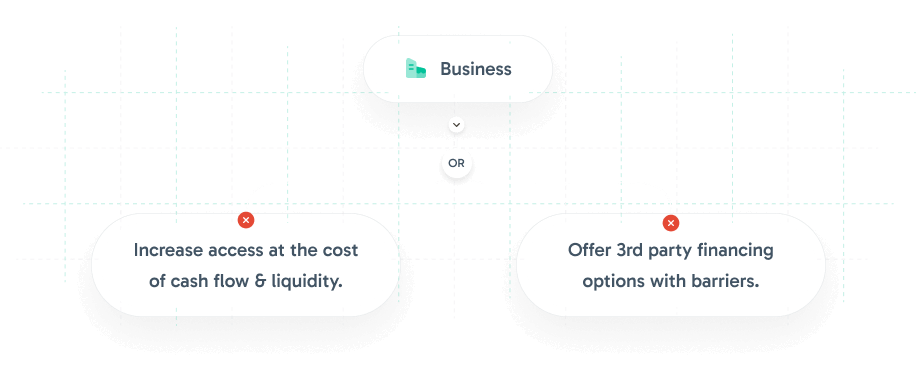

Businesses typically only have two options:

Credee introduces a cash-flow acceleration layer that gives businesses options — upfront or over time — without forcing a single financing model.

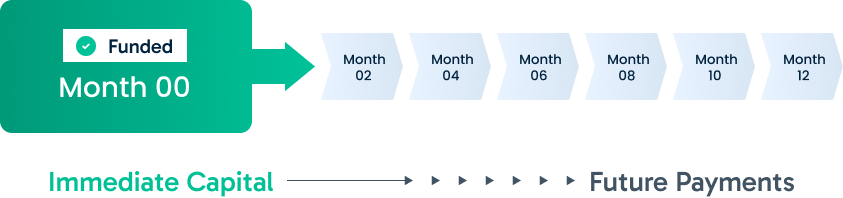

Upfront Funding

Credee can provide upfront funding at the start of a payment plan — allowing businesses to receive capital immediately instead of waiting over time.

Eligibility determined by Credee’s internal risk assessment

No loan origination or bank relationship required

Credee assumes the future payment risk

Receive capital at the start of the plan — without waiting on installments.

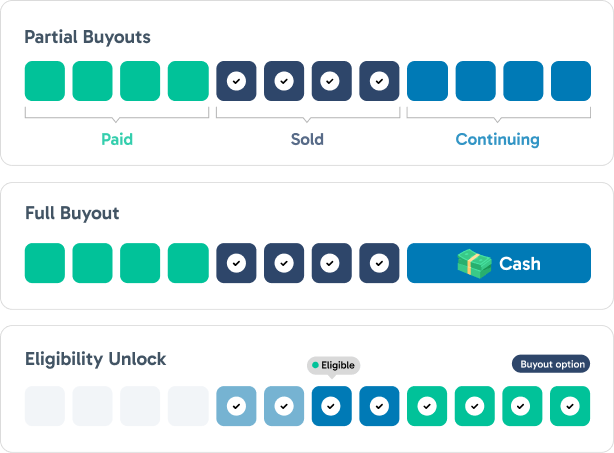

Early Buyouts

Businesses may have the option to sell a portion or the entirety of future payments back to Credee — converting remaining installments into cash.

- Partial (a subset of remaining installments)

- Full (the entire remaining balance)

- Available at the start or unlocked over time based on performance

Buyouts may be:

Acceleration,

When it’s needed.

Credee provides multiple ways to accelerate cash from eligible contracts — all embedded into the same infrastructure.

- This is not a commitment.

- It’s a capability.

Built for financial flexibility.

Cash-flow acceleration allows businesses to:

Reduce dependency on slow installment schedules

Smooth cash flow during growth or seasonality

Re-invest capital sooner

Maintain flexibility without committing upfront

Accelerate cash flow — on your terms

Explore how upfront funding and buyout options can be embedded into your existing payment workflows.