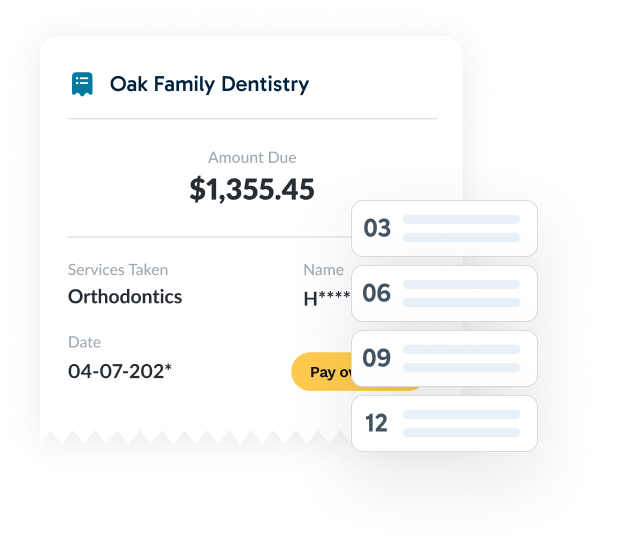

Where patient balances are substantial.

Dental organizations rely heavily on patient responsibility for high-value treatment — not minor copays, but substantial out-of-pocket balances tied to planned care, including:

Implants and

restorations

Orthodontics and

aligners

Surgical extractions/

Endodontics

Crowns, bridges

and veneers

Periodontal and specialty

procedures

When large balances are introduced into standard billing workflows, revenue becomes fragmented, delayed, and unpredictable.

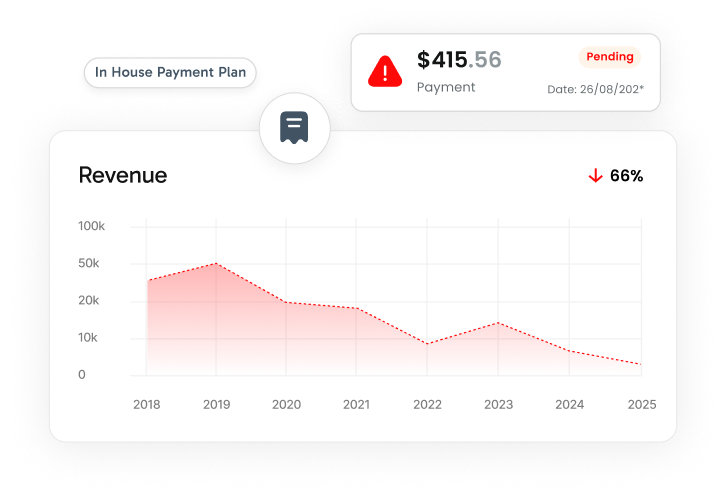

In house payment plans leak revenue.

More than 55% of patients who require flexible payment options fall outside traditional financing eligibility and end up being managed through internal payment arrangements.

These internal plans:

Sit outside standardized billing systems

Increase AR exposure over time

Rely on manual follow-up and enforcement

Create uneven revenue outcomes across locations

The issue isn’t acceptance — it’s infrastructure.

At the point of treatment.

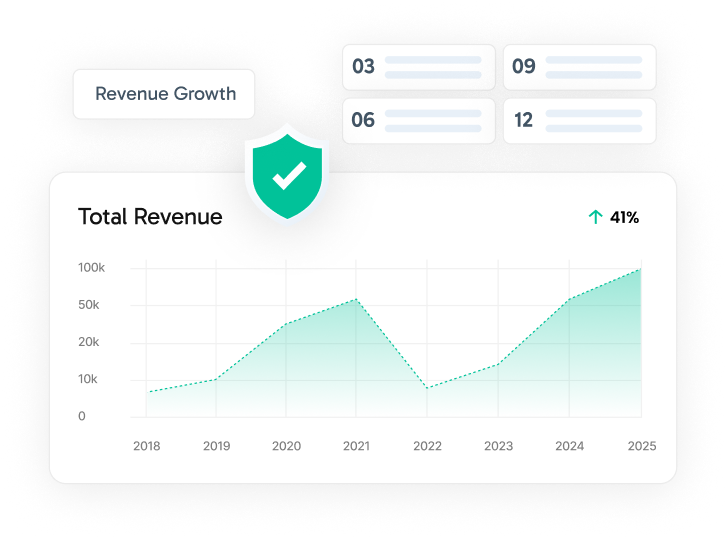

Credee embeds inside treatment-planning workflows — structuring patient-paid balances into managed payment contracts before they turn into AR or manual follow-up.

Instead of ad-hoc payment plans that vary by location, Credee:

Structures patient-pay balances into managed payment contracts

Runs billing and collection logic programmatically

Enables instant liquidity tools for eligible contracts

Applies revenue protection to reduce downside exposure

All while operating quietly under the dental organization’s brand and existing systems.

Designed for Enterprise Dental Organizations.

Credee is built to support:

Dental Support Organizations (DSOs)

Multi-location and specialty groups

Centralized billing and finance teams

It functions as a revenue layer, not just a point solution.